Selecting between various kinds of investments can really feel like navigating an unlimited sea with out a compass, particularly for these new to the world of finance. Certificates of deposit (CDs) and bonds are each fashionable funding choices, typically characterised as low-risk investments. However which one is likely to be higher suited in your monetary objectives? Let’s delve into this journey, evaluating CDs and bonds, demystifying their advantages, and explaining how every works intimately.

Diversification is certainly the cornerstone of any strong funding portfolio. Eager on including some crypto to your monetary combine? Changelly is your go-to resolution. Providing minimal charges and speedy transactions, it’s the final word gateway to the world of cryptocurrencies. Embark in your crypto funding journey right this moment with Changelly!

Understanding Certificates of Deposit (CDs): What are CDs?

A Certificates of Deposit, or CD, is a kind of financial savings account provided by banks and credit score unions. Not like an everyday financial savings account, a CD holds a hard and fast sum of money for a hard and fast interval. The interval, also known as the “time period,” can differ from just a few months to a number of years. In return for agreeing to depart your cash untouched for this time period, the monetary establishment pays you curiosity. Nevertheless, there’s a catch — if you might want to withdraw your funds earlier than the time period ends, you’ll face an early withdrawal penalty.

Kinds of CDs

The world of CDs is kind of various, with a number of sorts accessible:

Conventional CDs: That is the usual kind of CD that most individuals are aware of. You deposit your cash for a hard and fast time period and earn curiosity at a hard and fast fee. When the time period ends, you get again your preliminary deposit plus the gathered curiosity. In the event you withdraw your funds early, you’ll usually incur an early withdrawal penalty.

Bump-Up CDs: These give you the prospect to lift your rate of interest throughout the time period if the charges within the wider market enhance. It’s a option to hedge towards potential rises in rates of interest. Nonetheless, the preliminary fee is often decrease than the speed provided on conventional CDs.

Liquid CDs: These are extra versatile than conventional CDs as a result of they let you withdraw a part of your deposit with out paying an early withdrawal penalty. That stated, their rates of interest are usually decrease, and there could also be particular guidelines about when and the way a lot you’ll be able to withdraw.

Zero-Coupon CDs: A lot of these CDs don’t pay out curiosity yearly or semi-annually like conventional CDs. As a substitute, they routinely reinvest the curiosity earned, which suggests you obtain a lump sum cost (authentic deposit plus curiosity) on the finish of the time period.

Callable CDs: These CDs could be ‘referred to as’ or redeemed by the issuing financial institution earlier than the time period ends, usually when rates of interest fall. This implies chances are you’ll not get the total curiosity if the financial institution decides to name the CD.

Brokered CDs: Brokered CDs are purchased through a brokerage agency, moderately than straight from a financial institution. Regardless of being initiated by banks, their promoting is outsourced to corporations, sparking competitors and customarily larger yields than conventional CDs. Brokered CDs supply extra flexibility, although this could enhance the potential for funding errors.

Within the debate of cds vs bonds, it’s value noting that cds, other than providing a hard and fast rate of interest assured by the financial institution, are insured by the fdic, whereas bonds can supply doubtlessly larger yields however carry various levels of threat based mostly on the issuer.

Within the debate of CDs vs bonds, it’s value noting that CDs, other than providing a hard and fast rate of interest assured by the financial institution, are insured by the FDIC, whereas bonds can supply doubtlessly larger yields however carry various levels of threat based mostly on the issuer.

How Protected Are CDs?

CDs are broadly thought to be one of many most secure funding choices accessible. Issued by banks or credit score unions, they’re insured as much as $250,000 per depositor by the Federal Deposit Insurance coverage Company (FDIC) or the Nationwide Credit score Union Administration (NCUA). Because of this even within the occasion of the monetary establishment failing, you received’t lose your deposit.

When Is a CD Your Greatest Possibility?

In my skilled view, there are specific eventualities the place a CD is likely to be a superb alternative:

CDs could be opened at any financial institution or credit score union, and it’s also possible to purchase them by means of a brokerage agency.

Delving Into Bonds: What are Bonds?

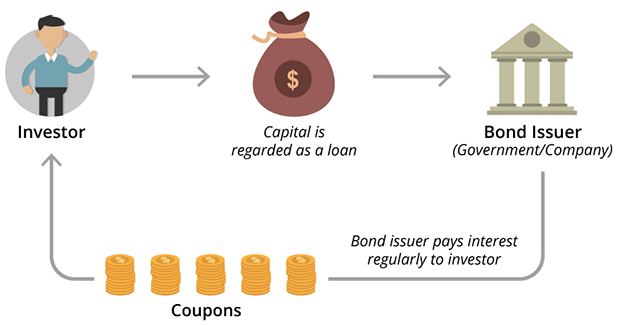

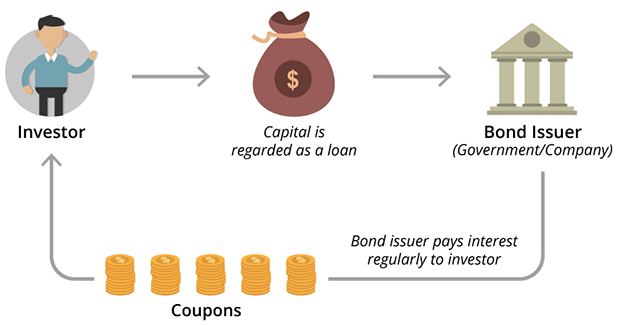

A bond is a type of mortgage that buyers make to bond issuers, which could be firms, municipalities, or the federal authorities. In return for the mortgage, the issuer guarantees to pay again the mortgage quantity, known as the “principal,” by a particular date generally known as the maturity date. In the meantime, the issuer additionally makes periodic curiosity funds to the bondholder.

In the event you’re evaluating a cd vs a treasury bond, take into account that treasury bonds could also be a greater choice when you’re on the lookout for a longer-term, lower-risk funding backed by the u. S. Authorities.

In the event you’re evaluating a CD vs a treasury bond, take into account that treasury bonds could also be a greater choice when you’re on the lookout for a longer-term, lower-risk funding backed by the U.S. authorities.

Kinds of Bonds

There are a number of forms of bonds to select from:

Authorities Bonds: These are issued by the federal authorities and are sometimes thought of the most secure kind of bond. They arrive in three varieties: Treasury Payments (T-Payments), Treasury Notes (T-Notes), and Treasury Bonds (T-Bonds). T-Payments have the shortest maturity (as much as 1 yr), whereas T-Notes and T-Bonds have longer maturities. The curiosity earned on these bonds is exempt from state and native taxes.

Municipal Bonds: Issued by states, cities, or different native authorities entities, municipal bonds fund public tasks like faculties, highways, and bridges. The curiosity paid on these bonds is often exempt from federal revenue tax and sometimes from state and native taxes as nicely when you stay within the state the place the bond is issued.

Company Bonds: Firms concern company bonds to lift capital for quite a lot of causes, from operational growth to funding analysis. These bonds often supply larger rates of interest than authorities and municipal bonds as a result of their elevated threat degree. The security of the bond is dependent upon the monetary well being of the corporate.

Financial savings Bonds: These are non-marketable securities issued by the U.S. Division of the Treasury and meant for common public funding. They’re bought in small denominations and have long-term maturities. The most typical sorts are Collection EE and Collection I financial savings bonds.

Company Bonds: These bonds are issued by government-sponsored enterprises (GSEs) and federal businesses. They’re thought of barely riskier than Treasury bonds however safer than company bonds.

Overseas Bonds: These are bonds issued by a international authorities or an organization situated outdoors of your property nation. Investing in international bonds introduces further dangers, resembling foreign money threat, however they will supply larger returns and extra diversification.

Bond Mutual Funds: These are funds that put money into numerous forms of bonds. Bond mutual funds supply diversification {and professional} administration, however the returns and principal worth can fluctuate.

How Protected Are Bonds?

Whereas bonds are usually thought of protected investments, their security can differ. For example, company bonds carry a threat of default, which means the corporate won’t be capable to make curiosity funds or return the principal. Then again, municipal bonds and financial savings bonds are backed by authorities entities and are usually thought of very low threat.

When Is a Bond Your Greatest Possibility?

Drawing on my expertise, I’d suggest contemplating bonds underneath these circumstances:

The place Can I Purchase Bonds?

You should buy bonds by means of brokerages, bond mutual funds, or, within the case of financial savings bonds, instantly from the U.S. Treasury Division.

Crypto Worth Alerts

Get each day alerts on value adjustments of the highest 10 cryptocurrencies.

Please allow JavaScript in your browser to finish this manner.

E mail *

Subscribe

Bonds vs. CDs: How Do They Work?

Let’s break down the internal workings of each CDs and bonds. Whereas they’re each generally labeled as safer funding choices, the way in which they operate and serve buyers could be fairly completely different.

How CDs Work

A Certificates of Deposit (CD) operates very like a time-specific financial savings account. While you open a CD, you deposit a hard and fast sum of money with a monetary establishment, like a financial institution or a credit score union, for a hard and fast interval. This era, also known as the time period, can vary from just a few months to a number of years.

The financial institution pays you curiosity on the cash you’ve deposited. The rate of interest is often fastened, which means it received’t change at some stage in the time period. So, you’ll know precisely how a lot your CD will earn over its lifespan.

On the finish of the time period, the CD matures. You’ll obtain the cash you initially deposited plus the curiosity you’ve earned. In the event you withdraw your cash earlier than the tip of the time period, you’ll probably should pay an early withdrawal penalty, which might eat into your earnings.

CDs are insured as much as $250,000 per depositor by the Federal Deposit Insurance coverage Company (FDIC) or the Nationwide Credit score Union Administration (NCUA) in the event that they’re provided by credit score unions. This implies even when the financial institution or credit score union fails, your funding is secured.

How Bonds Work

Bonds function extra like loans — however you’re the lender. While you buy a bond, you’re lending cash to the issuer of the bond. This issuer may very well be an organization, municipality, or the federal authorities. In return for the mortgage, the issuer guarantees to pay you a specified fee of curiosity throughout the lifetime of the bond and to repay the face worth of the bond (the principal) when it matures, or comes due.

The curiosity cost (additionally referred to as the coupon cost) is often paid semiannually. The speed is both fastened, which means it received’t change for the lifetime of the bond, or variable, adjusting with market circumstances.

Bonds’ security varies relying on the issuer. U.S. Treasury bonds, backed by the total religion and credit score of the U.S. authorities, are thought of the most secure. Company bonds have completely different levels of threat hinging on the monetary well being of the corporate. Municipal bonds’ security is dependent upon the monetary well being of the issuing native authorities. Generally, the upper the chance, the upper the rate of interest the bond pays to compensate buyers for taking over the extra threat.

Not like CDs, bonds could be purchased and bought on the secondary market earlier than they mature. This supplies liquidity but in addition introduces value threat. If you might want to promote a bond earlier than it matures, its value will depend upon the present rate of interest surroundings and the issuer’s creditworthiness. If rates of interest have risen since to procure the bond, its worth could have fallen, and also you’ll get lower than what you paid when you promote.

To summarize, whereas each CDs and bonds are instruments for producing revenue, they operate in another way. CDs are time deposits with banks or credit score unions, providing fastened, insured returns, excellent for short-to-medium-term monetary objectives. Bonds are primarily loans to firms, municipalities, or the federal government. They provide variable returns (often larger than CDs) and carry completely different ranges of threat, which makes them appropriate for a wider vary of funding methods and timelines.

What’s the Distinction Between CD and Bond? A Detailed Comparability

Security

CDs and bonds are thought of comparatively protected. CDs, being insured by the FDIC or NCUA, supply a assured return in your principal as much as the insured quantity. Bonds’ security, however, is dependent upon the issuer’s creditworthiness. Authorities-issued bonds are usually thought of safer than company bonds.

Minimal Funding Necessities

Bonds typically require larger minimal investments than CDs, generally going into the hundreds of {dollars}. CDs, nevertheless, could be opened with just a few hundred {dollars}, making them extra accessible to buyers with much less capital.

Liquidity

Bonds usually supply extra liquidity than CDs. If you might want to money in your funding, you’ll be able to promote bonds earlier than their maturity date with out a penalty. However, chances are you’ll get lower than the face worth if bond costs have fallen. Contrariwise, CDs impose an early withdrawal penalty, making them much less liquid.

Issuers and Safety

CDs are issued by banks and credit score unions and are insured by the FDIC or NCUA. This insurance coverage protects your funding even when the establishment fails. For bonds, the mechanics are fairly completely different: they’re issued by firms, municipalities, and the federal authorities. The security of your bond funding primarily is dependent upon the creditworthiness of the issuer.

Returns

Bonds typically present larger returns than CDs, relying on the kind of bond and the issuer’s creditworthiness. This potential for larger returns comes with an elevated threat. CDs supply a hard and fast rate of interest and decrease threat however typically yield decrease returns.

Penalties

In the event you withdraw cash from a CD earlier than its maturity date, you’ll incur an early withdrawal penalty. This may eat into your earned curiosity and generally even your principal. Bonds shouldn’t have early withdrawal penalties, however when you promote a bond earlier than its maturity date, its worth is likely to be lower than your authentic funding if bond costs have fallen.

Dangers

Whereas each CDs and bonds are thought of low-risk investments, they’ve their distinctive dangers. CDs include reinvestment threat, which is the chance that when your CD matures, you will have to reinvest your cash at a decrease rate of interest. Bonds, however, carry rate of interest threat, which signifies that if rates of interest rise, bond costs will fall, and vice versa.

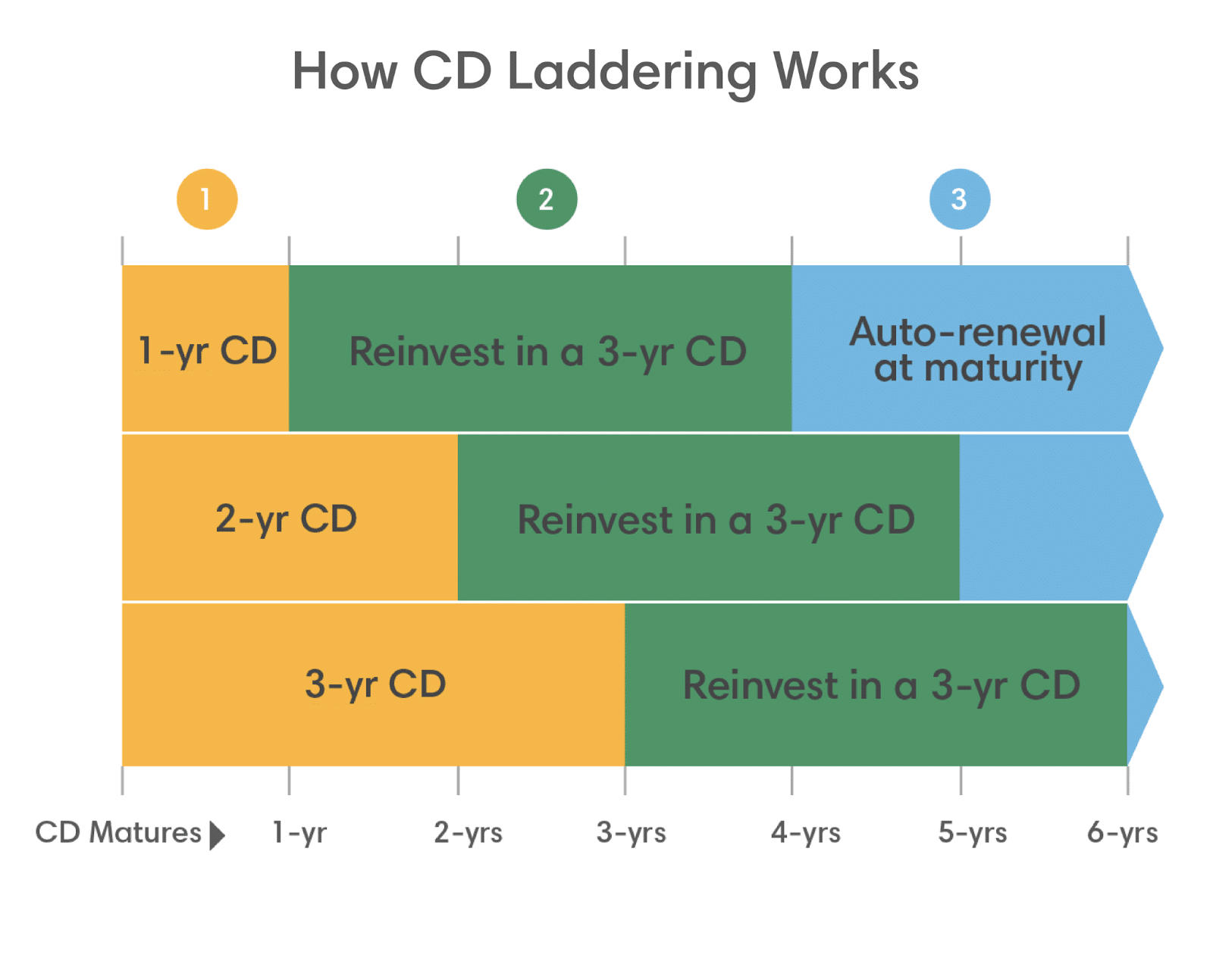

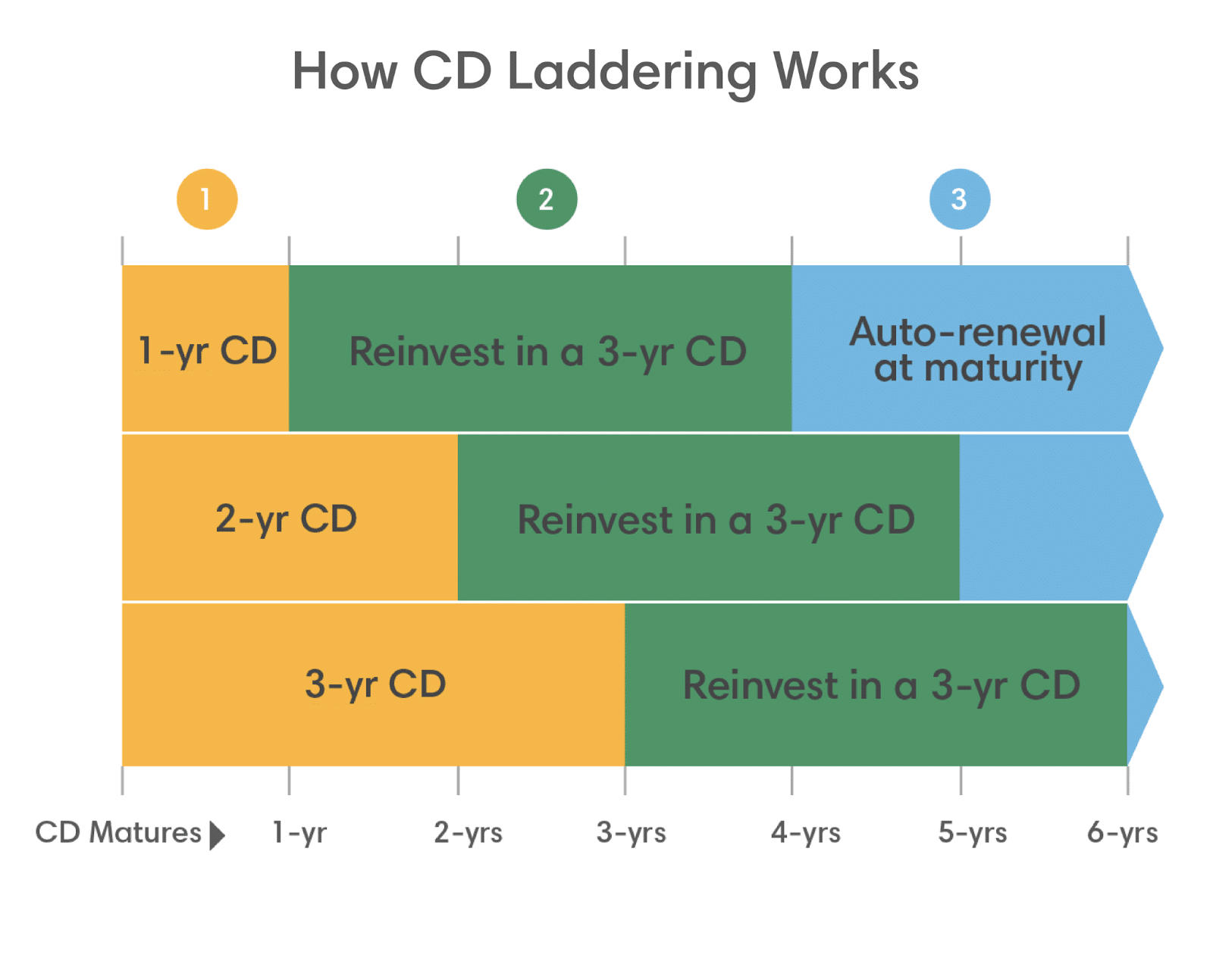

The “Laddering” Method for Investing in Bonds and CDs

Understanding handle your funding in bonds and CDs could make a big distinction in your return and total expertise. In my experience, one of the efficient methods is the “Laddering” method.

When deciding between cds vs bonds, the technique of laddering may very well be an efficient option to stability the liquidity and rate of interest dangers of each these fixed-income investments.

When deciding between CDs vs bonds, the technique of laddering may very well be an efficient option to stability the liquidity and rate of interest dangers of each these fixed-income investments.

Let’s first make clear what precisely laddering is. While you “ladder” your CDs or bonds, you’re primarily diversifying your investments throughout completely different maturity dates. Think about this technique as a ladder the place every rung represents a special maturity date, and the peak corresponds to the size of the funding time period.

For example, as a substitute of investing $15,000 right into a single five-year CD, you might unfold the funding throughout 5 CDs, every maturing one yr aside. So, you would possibly buy 5 CDs value $3,000 every with phrases of 1, two, three, 4, and 5 years. That is your ladder.

Now let’s transfer on to why I take into account this a powerful technique. Firstly, laddering reduces the affect of rate of interest fluctuations. If your whole cash is tied up in a single long-term CD or bond, and rates of interest rise, you miss out on these larger charges. Nevertheless, with a laddered portfolio, a few of your investments mature earlier, permitting you to make the most of rising rates of interest by reinvesting at these larger charges.

Secondly, laddering can present a degree of liquidity that one usually doesn’t affiliate with CDs and bonds. As every “rung” of your ladder matures, you’ve gotten the choice to entry your cash if wanted, with out incurring early withdrawal penalties that will usually be related to accessing a single long-term CD or bond prematurely.

Utilizing my data, I’d recommend laddering for many who wish to put money into CDs or bonds but in addition wish to mitigate rate of interest threat and preserve some liquidity. This method creates a stability between having fun with the upper charges provided by long-term investments and the pliability of short-term ones.

In conclusion, based mostly on my experience within the area, I’d suggest the laddering method as a balanced, strategic technique of investing in CDs and bonds. This method means that you can seize excessive rates of interest, supplies common entry to funds with out penalties, and reduces the chance of locking your entire funding at low charges. Nonetheless, as with all funding methods, it’s important to think about your monetary scenario, threat tolerance, and funding objectives.

Though each are thought of safer investments, the important thing distinction in a cd vs a treasury bond dialogue lies in liquidity — cds usually incur penalties for early withdrawal, whereas treasury bonds could be bought on the secondary market. A cd nonetheless may very well be a more sensible choice than a treasury bond when you desire to take a position with a financial institution or credit score union and worth the fdic or ncua insurance coverage.

Though each are thought of safer investments, the important thing distinction in a CD vs a treasury bond dialogue lies in liquidity — CDs usually incur penalties for early withdrawal, whereas treasury bonds could be bought on the secondary market. A CD nonetheless may very well be a more sensible choice than a treasury bond when you desire to take a position with a financial institution or credit score union and worth the FDIC or NCUA insurance coverage.

Bond vs. CD: FAQs

Are you able to lose cash investing in CDs?

In idea, you can not lose your principal in a CD as it’s insured by the FDIC or NCUA. Nevertheless, an early withdrawal penalty may scale back your total return and, in some circumstances, eat into your principal.

That are the very best bonds to purchase now?

One of the best bonds to purchase rely in your funding objectives and threat tolerance. Authorities bonds are very protected however supply decrease returns. Company bonds supply larger potential returns however carry extra threat. Diversifying your bond investments, like investing in bond mutual funds, may very well be a very good technique to stability threat and reward.

What is best, a CD or a bond?

The selection is dependent upon your monetary objectives, threat tolerance, and the time-frame for if you would possibly want entry to your funds. In the event you’re on the lookout for a safer, low-risk choice and might afford to depart your funding untouched for a particular interval, a CD is likely to be higher. In the event you want extra flexibility and the potential for larger returns, a bond may very well be a superior alternative.

Are bonds extra liquid than CDs?

Sure, bonds are usually extra liquid than CDs. You’ll be able to promote bonds earlier than their maturity date on the secondary market with out incurring a penalty. Then again, when you withdraw cash from a CD earlier than its maturity date, you’ll face an early withdrawal penalty. It’s value protecting in thoughts, although, that the quantity you get in your bond is likely to be lower than its face worth if bond costs have fallen.

Are bonds or CDs riskier?

Whereas each are thought of comparatively low-risk investments, bonds could be riskier than CDs. The danger related to bonds largely is dependent upon the creditworthiness of the issuer. For example, company bonds can carry a threat of default. CDs, nevertheless, are insured by the FDIC or NCUA, guaranteeing the return of your principal as much as the insured quantity, making them much less dangerous.

Is a CD an asset?

Sure, a CD is taken into account an asset. While you buy a CD, you might be primarily lending cash to a financial institution or a credit score union for a set interval, and in return, you obtain a assured quantity of curiosity. This funding, together with each the unique deposit and the earned curiosity, is a part of your monetary belongings.

The Backside Line

CDs and bonds supply beneficial methods to diversify your funding portfolio. CDs are higher suited to risk-averse buyers who need a assured return and don’t want rapid entry to their funds. Bonds can supply larger potential returns; they’re suited to buyers on the lookout for common revenue and the pliability to promote earlier than maturity.

Earlier than investing, keep in mind to concentrate to prevailing and anticipated future rates of interest. If charges are anticipated to rise, short-term bonds or CDs could also be useful as they’d let you reinvest at larger charges sooner. If charges are predicted to fall, longer-term CDs or bonds could also be extra enticing — they’d allow you to lock in the next fee for an extended interval.

Most significantly, perceive your threat tolerance and monetary objectives earlier than investing, and take into account in search of recommendation from a monetary advisor when you’re not sure. Completely happy investing!

References

The put up CDs vs. Bonds: Which Is a Higher Funding? A Complete Information appeared first on Cryptocurrency Information & Buying and selling Ideas – Crypto Weblog by Changelly.

Crypto exchanges are online platforms where digital assets are bought and sold. Users can trade, buy, and invest in cryptocurrencies on these platforms. Exchanges provide services such as secure account creation, placing trade orders, and storage. However, it's important to consider security risks and volatility. Users should pay attention to factors like reliability, security measures, and regulations when choosing an exchange. Crypto exchanges are a significant part of the crypto ecosystem.

Diversification is certainly the cornerstone of any strong funding portfolio. Eager on including some crypto to your monetary combine? Changelly is your go-to resolution. Providing minimal charges and speedy transactions, it’s the final word gateway to the world of cryptocurrencies. Embark in your crypto funding journey right this moment with Changelly!

Understanding Certificates of Deposit (CDs): What are CDs?

A Certificates of Deposit, or CD, is a kind of financial savings account provided by banks and credit score unions. Not like an everyday financial savings account, a CD holds a hard and fast sum of money for a hard and fast interval. The interval, also known as the “time period,” can differ from just a few months to a number of years. In return for agreeing to depart your cash untouched for this time period, the monetary establishment pays you curiosity. Nevertheless, there’s a catch — if you might want to withdraw your funds earlier than the time period ends, you’ll face an early withdrawal penalty.

Kinds of CDs

The world of CDs is kind of various, with a number of sorts accessible:

Conventional CDs: That is the usual kind of CD that most individuals are aware of. You deposit your cash for a hard and fast time period and earn curiosity at a hard and fast fee. When the time period ends, you get again your preliminary deposit plus the gathered curiosity. In the event you withdraw your funds early, you’ll usually incur an early withdrawal penalty.

Bump-Up CDs: These give you the prospect to lift your rate of interest throughout the time period if the charges within the wider market enhance. It’s a option to hedge towards potential rises in rates of interest. Nonetheless, the preliminary fee is often decrease than the speed provided on conventional CDs.

Liquid CDs: These are extra versatile than conventional CDs as a result of they let you withdraw a part of your deposit with out paying an early withdrawal penalty. That stated, their rates of interest are usually decrease, and there could also be particular guidelines about when and the way a lot you’ll be able to withdraw.

Zero-Coupon CDs: A lot of these CDs don’t pay out curiosity yearly or semi-annually like conventional CDs. As a substitute, they routinely reinvest the curiosity earned, which suggests you obtain a lump sum cost (authentic deposit plus curiosity) on the finish of the time period.

Callable CDs: These CDs could be ‘referred to as’ or redeemed by the issuing financial institution earlier than the time period ends, usually when rates of interest fall. This implies chances are you’ll not get the total curiosity if the financial institution decides to name the CD.

Brokered CDs: Brokered CDs are purchased through a brokerage agency, moderately than straight from a financial institution. Regardless of being initiated by banks, their promoting is outsourced to corporations, sparking competitors and customarily larger yields than conventional CDs. Brokered CDs supply extra flexibility, although this could enhance the potential for funding errors.

Within the debate of cds vs bonds, it’s value noting that cds, other than providing a hard and fast rate of interest assured by the financial institution, are insured by the fdic, whereas bonds can supply doubtlessly larger yields however carry various levels of threat based mostly on the issuer.

Within the debate of CDs vs bonds, it’s value noting that CDs, other than providing a hard and fast rate of interest assured by the financial institution, are insured by the FDIC, whereas bonds can supply doubtlessly larger yields however carry various levels of threat based mostly on the issuer.

How Protected Are CDs?

CDs are broadly thought to be one of many most secure funding choices accessible. Issued by banks or credit score unions, they’re insured as much as $250,000 per depositor by the Federal Deposit Insurance coverage Company (FDIC) or the Nationwide Credit score Union Administration (NCUA). Because of this even within the occasion of the monetary establishment failing, you received’t lose your deposit.

When Is a CD Your Greatest Possibility?

In my skilled view, there are specific eventualities the place a CD is likely to be a superb alternative:

- Outlined Brief-Time period Aims: You probably have a concrete purpose on the horizon — a down cost for a house, a brand new automotive, or perhaps a dream trip — and also you’ve diligently saved for this goal, a CD may function a useful vessel for this nest egg. Because of its fastened rate of interest, a CD ensures that your cash will develop with none threat of market fluctuations. Nevertheless, make sure that your saving timeline aligns with the CD’s time period to keep away from an early withdrawal penalty.

- Need for Predictable Returns and Excessive Safety: While you prioritize security and predictability, a CD shines. Your returns are spelled out from the start, and there aren’t any market circumstances that may jeopardize your preliminary deposit. Furthermore, the backing of the FDIC or NCUA provides you an ironclad assure that your investments, as much as $250,000, are safe even when a financial institution or a credit score union fails.

CDs could be opened at any financial institution or credit score union, and it’s also possible to purchase them by means of a brokerage agency.

Delving Into Bonds: What are Bonds?

A bond is a type of mortgage that buyers make to bond issuers, which could be firms, municipalities, or the federal authorities. In return for the mortgage, the issuer guarantees to pay again the mortgage quantity, known as the “principal,” by a particular date generally known as the maturity date. In the meantime, the issuer additionally makes periodic curiosity funds to the bondholder.

In the event you’re evaluating a cd vs a treasury bond, take into account that treasury bonds could also be a greater choice when you’re on the lookout for a longer-term, lower-risk funding backed by the u. S. Authorities.

In the event you’re evaluating a CD vs a treasury bond, take into account that treasury bonds could also be a greater choice when you’re on the lookout for a longer-term, lower-risk funding backed by the U.S. authorities.

Kinds of Bonds

There are a number of forms of bonds to select from:

Authorities Bonds: These are issued by the federal authorities and are sometimes thought of the most secure kind of bond. They arrive in three varieties: Treasury Payments (T-Payments), Treasury Notes (T-Notes), and Treasury Bonds (T-Bonds). T-Payments have the shortest maturity (as much as 1 yr), whereas T-Notes and T-Bonds have longer maturities. The curiosity earned on these bonds is exempt from state and native taxes.

Municipal Bonds: Issued by states, cities, or different native authorities entities, municipal bonds fund public tasks like faculties, highways, and bridges. The curiosity paid on these bonds is often exempt from federal revenue tax and sometimes from state and native taxes as nicely when you stay within the state the place the bond is issued.

Company Bonds: Firms concern company bonds to lift capital for quite a lot of causes, from operational growth to funding analysis. These bonds often supply larger rates of interest than authorities and municipal bonds as a result of their elevated threat degree. The security of the bond is dependent upon the monetary well being of the corporate.

Financial savings Bonds: These are non-marketable securities issued by the U.S. Division of the Treasury and meant for common public funding. They’re bought in small denominations and have long-term maturities. The most typical sorts are Collection EE and Collection I financial savings bonds.

Company Bonds: These bonds are issued by government-sponsored enterprises (GSEs) and federal businesses. They’re thought of barely riskier than Treasury bonds however safer than company bonds.

Overseas Bonds: These are bonds issued by a international authorities or an organization situated outdoors of your property nation. Investing in international bonds introduces further dangers, resembling foreign money threat, however they will supply larger returns and extra diversification.

Bond Mutual Funds: These are funds that put money into numerous forms of bonds. Bond mutual funds supply diversification {and professional} administration, however the returns and principal worth can fluctuate.

How Protected Are Bonds?

Whereas bonds are usually thought of protected investments, their security can differ. For example, company bonds carry a threat of default, which means the corporate won’t be capable to make curiosity funds or return the principal. Then again, municipal bonds and financial savings bonds are backed by authorities entities and are usually thought of very low threat.

When Is a Bond Your Greatest Possibility?

Drawing on my expertise, I’d suggest contemplating bonds underneath these circumstances:

- Balancing a Inventory-Heavy Portfolio: Bonds may very well be the suitable choice when you search to stability the chance, having already invested within the inventory market. They will act as a counterweight to the inherent volatility of shares, smoothing out potential tough patches and offering extra stability to your portfolio.

- Lengthy-Time period Common Revenue: In the event you’re drawn to the concept of your funding producing constant revenue over an prolonged interval, bonds match the invoice completely. They make common curiosity funds over their life cycle and return the preliminary funding at maturity, but it surely’s necessary to evaluate the monetary well being of the bond issuer, particularly with company bonds, to mitigate any default dangers.

The place Can I Purchase Bonds?

You should buy bonds by means of brokerages, bond mutual funds, or, within the case of financial savings bonds, instantly from the U.S. Treasury Division.

Crypto Worth Alerts

Get each day alerts on value adjustments of the highest 10 cryptocurrencies.

Please allow JavaScript in your browser to finish this manner.

E mail *

Subscribe

Bonds vs. CDs: How Do They Work?

Let’s break down the internal workings of each CDs and bonds. Whereas they’re each generally labeled as safer funding choices, the way in which they operate and serve buyers could be fairly completely different.

How CDs Work

A Certificates of Deposit (CD) operates very like a time-specific financial savings account. While you open a CD, you deposit a hard and fast sum of money with a monetary establishment, like a financial institution or a credit score union, for a hard and fast interval. This era, also known as the time period, can vary from just a few months to a number of years.

The financial institution pays you curiosity on the cash you’ve deposited. The rate of interest is often fastened, which means it received’t change at some stage in the time period. So, you’ll know precisely how a lot your CD will earn over its lifespan.

On the finish of the time period, the CD matures. You’ll obtain the cash you initially deposited plus the curiosity you’ve earned. In the event you withdraw your cash earlier than the tip of the time period, you’ll probably should pay an early withdrawal penalty, which might eat into your earnings.

CDs are insured as much as $250,000 per depositor by the Federal Deposit Insurance coverage Company (FDIC) or the Nationwide Credit score Union Administration (NCUA) in the event that they’re provided by credit score unions. This implies even when the financial institution or credit score union fails, your funding is secured.

How Bonds Work

Bonds function extra like loans — however you’re the lender. While you buy a bond, you’re lending cash to the issuer of the bond. This issuer may very well be an organization, municipality, or the federal authorities. In return for the mortgage, the issuer guarantees to pay you a specified fee of curiosity throughout the lifetime of the bond and to repay the face worth of the bond (the principal) when it matures, or comes due.

The curiosity cost (additionally referred to as the coupon cost) is often paid semiannually. The speed is both fastened, which means it received’t change for the lifetime of the bond, or variable, adjusting with market circumstances.

Bonds’ security varies relying on the issuer. U.S. Treasury bonds, backed by the total religion and credit score of the U.S. authorities, are thought of the most secure. Company bonds have completely different levels of threat hinging on the monetary well being of the corporate. Municipal bonds’ security is dependent upon the monetary well being of the issuing native authorities. Generally, the upper the chance, the upper the rate of interest the bond pays to compensate buyers for taking over the extra threat.

Not like CDs, bonds could be purchased and bought on the secondary market earlier than they mature. This supplies liquidity but in addition introduces value threat. If you might want to promote a bond earlier than it matures, its value will depend upon the present rate of interest surroundings and the issuer’s creditworthiness. If rates of interest have risen since to procure the bond, its worth could have fallen, and also you’ll get lower than what you paid when you promote.

To summarize, whereas each CDs and bonds are instruments for producing revenue, they operate in another way. CDs are time deposits with banks or credit score unions, providing fastened, insured returns, excellent for short-to-medium-term monetary objectives. Bonds are primarily loans to firms, municipalities, or the federal government. They provide variable returns (often larger than CDs) and carry completely different ranges of threat, which makes them appropriate for a wider vary of funding methods and timelines.

What’s the Distinction Between CD and Bond? A Detailed Comparability

Security

CDs and bonds are thought of comparatively protected. CDs, being insured by the FDIC or NCUA, supply a assured return in your principal as much as the insured quantity. Bonds’ security, however, is dependent upon the issuer’s creditworthiness. Authorities-issued bonds are usually thought of safer than company bonds.

Minimal Funding Necessities

Bonds typically require larger minimal investments than CDs, generally going into the hundreds of {dollars}. CDs, nevertheless, could be opened with just a few hundred {dollars}, making them extra accessible to buyers with much less capital.

Liquidity

Bonds usually supply extra liquidity than CDs. If you might want to money in your funding, you’ll be able to promote bonds earlier than their maturity date with out a penalty. However, chances are you’ll get lower than the face worth if bond costs have fallen. Contrariwise, CDs impose an early withdrawal penalty, making them much less liquid.

Issuers and Safety

CDs are issued by banks and credit score unions and are insured by the FDIC or NCUA. This insurance coverage protects your funding even when the establishment fails. For bonds, the mechanics are fairly completely different: they’re issued by firms, municipalities, and the federal authorities. The security of your bond funding primarily is dependent upon the creditworthiness of the issuer.

Returns

Bonds typically present larger returns than CDs, relying on the kind of bond and the issuer’s creditworthiness. This potential for larger returns comes with an elevated threat. CDs supply a hard and fast rate of interest and decrease threat however typically yield decrease returns.

Penalties

In the event you withdraw cash from a CD earlier than its maturity date, you’ll incur an early withdrawal penalty. This may eat into your earned curiosity and generally even your principal. Bonds shouldn’t have early withdrawal penalties, however when you promote a bond earlier than its maturity date, its worth is likely to be lower than your authentic funding if bond costs have fallen.

Dangers

Whereas each CDs and bonds are thought of low-risk investments, they’ve their distinctive dangers. CDs include reinvestment threat, which is the chance that when your CD matures, you will have to reinvest your cash at a decrease rate of interest. Bonds, however, carry rate of interest threat, which signifies that if rates of interest rise, bond costs will fall, and vice versa.

The “Laddering” Method for Investing in Bonds and CDs

Understanding handle your funding in bonds and CDs could make a big distinction in your return and total expertise. In my experience, one of the efficient methods is the “Laddering” method.

When deciding between cds vs bonds, the technique of laddering may very well be an efficient option to stability the liquidity and rate of interest dangers of each these fixed-income investments.

When deciding between CDs vs bonds, the technique of laddering may very well be an efficient option to stability the liquidity and rate of interest dangers of each these fixed-income investments.

Let’s first make clear what precisely laddering is. While you “ladder” your CDs or bonds, you’re primarily diversifying your investments throughout completely different maturity dates. Think about this technique as a ladder the place every rung represents a special maturity date, and the peak corresponds to the size of the funding time period.

For example, as a substitute of investing $15,000 right into a single five-year CD, you might unfold the funding throughout 5 CDs, every maturing one yr aside. So, you would possibly buy 5 CDs value $3,000 every with phrases of 1, two, three, 4, and 5 years. That is your ladder.

Now let’s transfer on to why I take into account this a powerful technique. Firstly, laddering reduces the affect of rate of interest fluctuations. If your whole cash is tied up in a single long-term CD or bond, and rates of interest rise, you miss out on these larger charges. Nevertheless, with a laddered portfolio, a few of your investments mature earlier, permitting you to make the most of rising rates of interest by reinvesting at these larger charges.

Secondly, laddering can present a degree of liquidity that one usually doesn’t affiliate with CDs and bonds. As every “rung” of your ladder matures, you’ve gotten the choice to entry your cash if wanted, with out incurring early withdrawal penalties that will usually be related to accessing a single long-term CD or bond prematurely.

Utilizing my data, I’d recommend laddering for many who wish to put money into CDs or bonds but in addition wish to mitigate rate of interest threat and preserve some liquidity. This method creates a stability between having fun with the upper charges provided by long-term investments and the pliability of short-term ones.

In conclusion, based mostly on my experience within the area, I’d suggest the laddering method as a balanced, strategic technique of investing in CDs and bonds. This method means that you can seize excessive rates of interest, supplies common entry to funds with out penalties, and reduces the chance of locking your entire funding at low charges. Nonetheless, as with all funding methods, it’s important to think about your monetary scenario, threat tolerance, and funding objectives.

Though each are thought of safer investments, the important thing distinction in a cd vs a treasury bond dialogue lies in liquidity — cds usually incur penalties for early withdrawal, whereas treasury bonds could be bought on the secondary market. A cd nonetheless may very well be a more sensible choice than a treasury bond when you desire to take a position with a financial institution or credit score union and worth the fdic or ncua insurance coverage.

Though each are thought of safer investments, the important thing distinction in a CD vs a treasury bond dialogue lies in liquidity — CDs usually incur penalties for early withdrawal, whereas treasury bonds could be bought on the secondary market. A CD nonetheless may very well be a more sensible choice than a treasury bond when you desire to take a position with a financial institution or credit score union and worth the FDIC or NCUA insurance coverage.

Bond vs. CD: FAQs

Are you able to lose cash investing in CDs?

In idea, you can not lose your principal in a CD as it’s insured by the FDIC or NCUA. Nevertheless, an early withdrawal penalty may scale back your total return and, in some circumstances, eat into your principal.

That are the very best bonds to purchase now?

One of the best bonds to purchase rely in your funding objectives and threat tolerance. Authorities bonds are very protected however supply decrease returns. Company bonds supply larger potential returns however carry extra threat. Diversifying your bond investments, like investing in bond mutual funds, may very well be a very good technique to stability threat and reward.

What is best, a CD or a bond?

The selection is dependent upon your monetary objectives, threat tolerance, and the time-frame for if you would possibly want entry to your funds. In the event you’re on the lookout for a safer, low-risk choice and might afford to depart your funding untouched for a particular interval, a CD is likely to be higher. In the event you want extra flexibility and the potential for larger returns, a bond may very well be a superior alternative.

Are bonds extra liquid than CDs?

Sure, bonds are usually extra liquid than CDs. You’ll be able to promote bonds earlier than their maturity date on the secondary market with out incurring a penalty. Then again, when you withdraw cash from a CD earlier than its maturity date, you’ll face an early withdrawal penalty. It’s value protecting in thoughts, although, that the quantity you get in your bond is likely to be lower than its face worth if bond costs have fallen.

Are bonds or CDs riskier?

Whereas each are thought of comparatively low-risk investments, bonds could be riskier than CDs. The danger related to bonds largely is dependent upon the creditworthiness of the issuer. For example, company bonds can carry a threat of default. CDs, nevertheless, are insured by the FDIC or NCUA, guaranteeing the return of your principal as much as the insured quantity, making them much less dangerous.

Is a CD an asset?

Sure, a CD is taken into account an asset. While you buy a CD, you might be primarily lending cash to a financial institution or a credit score union for a set interval, and in return, you obtain a assured quantity of curiosity. This funding, together with each the unique deposit and the earned curiosity, is a part of your monetary belongings.

The Backside Line

CDs and bonds supply beneficial methods to diversify your funding portfolio. CDs are higher suited to risk-averse buyers who need a assured return and don’t want rapid entry to their funds. Bonds can supply larger potential returns; they’re suited to buyers on the lookout for common revenue and the pliability to promote earlier than maturity.

Earlier than investing, keep in mind to concentrate to prevailing and anticipated future rates of interest. If charges are anticipated to rise, short-term bonds or CDs could also be useful as they’d let you reinvest at larger charges sooner. If charges are predicted to fall, longer-term CDs or bonds could also be extra enticing — they’d allow you to lock in the next fee for an extended interval.

Most significantly, perceive your threat tolerance and monetary objectives earlier than investing, and take into account in search of recommendation from a monetary advisor when you’re not sure. Completely happy investing!

References

- https://www.bankrate.com/banking/cds/how-do-cds-work/

- https://investor.vanguard.com/investor-resources-education/understanding-investment-types/what-is-a-bond

- https://www.dbs.com.sg/private/investments/fixed-income/understanding-bonds#

- https://www.investor.gov/introduction-investing/investing-basics/investment-products/certificates-deposit-cds

- https://mint.intuit.com/weblog/investments/money-market-vs-cd/

- https://www.idiot.com/investing/how-to-invest/bonds/

The put up CDs vs. Bonds: Which Is a Higher Funding? A Complete Information appeared first on Cryptocurrency Information & Buying and selling Ideas – Crypto Weblog by Changelly.

Crypto exchanges are online platforms where digital assets are bought and sold. Users can trade, buy, and invest in cryptocurrencies on these platforms. Exchanges provide services such as secure account creation, placing trade orders, and storage. However, it's important to consider security risks and volatility. Users should pay attention to factors like reliability, security measures, and regulations when choosing an exchange. Crypto exchanges are a significant part of the crypto ecosystem.

Last edited by a moderator: